So, you're ready to dive into a competitor analysis. This isn't just about spying on your rivals; it's a strategic process of identifying who you're up against, figuring out what they're doing right (and wrong), and using that intel to make smarter decisions for your own business.

It really boils down to three core activities: figuring out your goals, identifying your direct and indirect competitors, and then gathering the right data on their marketing, products, and what their customers are saying.

Setting the Stage for a Powerful Analysis

Before you even think about opening a spreadsheet or firing up an analytics tool, let’s get one thing straight. The whole point here isn't to copy your competitors. It's about systematically understanding the world you're operating in so you can find your unique edge and make it even sharper.

Doing this foundational work first saves you from a classic pitfall: collecting a mountain of data that seems interesting but doesn't actually help you do anything differently.

Define Your Primary Objective

First things first: what question are you actually trying to answer? A clear, focused goal is what makes this entire process efficient and genuinely useful.

Are you looking to:

- Refine your pricing strategy? If so, you'll need to dig into competitor price points, discount strategies, and what customers think they're worth.

- Find gaps in your content? This means you'll be focused on their blog, social media presence, and SEO performance to see what topics they aren't covering.

- Improve your customer service? This requires getting into the weeds of their online reviews, social media comments, and support channels.

- Benchmark your own marketing? You'll be analyzing their ad campaigns, social media engagement, and email marketing tactics.

Setting a clear goal is the difference between conducting a competitor audit and a random fact-finding mission. An audit has a purpose; a mission without a map leads nowhere.

Identify Your True Competitors

Once you know what you’re looking for, you need to know who you’re looking at. Too many businesses make the mistake of only watching their most obvious, direct competitors. A truly comprehensive analysis requires a much wider lens. This is how you spot both immediate threats and future opportunities.

Let’s be clear, the competitive intelligence (CI) software market is exploding. It's projected to jump from $2.56 billion in 2023 to a massive $6.02 billion by 2030. The best modern CI frameworks don't just look at direct rivals anymore; they analyze adjacent industries and even supply chain players to give businesses a real strategic advantage. You can find more insights on these competitive intelligence trends and how they impact business strategy.

To get a full picture, you need to think about different types of rivals. Breaking them down into categories helps you prioritize your research and see the market from every angle, making sure you don't get blindsided by a player you weren't even watching.

Here's a simple breakdown of the different types of competitors you should have on your radar.

Types of Competitors to Analyze

| Competitor Type | Definition | Example |

|---|---|---|

| Direct Competitors | Businesses that offer a very similar product or service to the same target audience. | For a project management tool like Asana, a direct competitor is Monday.com. |

| Indirect Competitors | Businesses that solve the same problem for the same audience but with a different product or service. | For Asana, an indirect competitor could be a simple to-do list app like Todoist or even a shared spreadsheet. |

| Tertiary Competitors | Businesses with related products or services that may not be direct competitors now but could be in the future. | For Asana, a tertiary competitor might be a company like Slack, which could expand its features to compete more directly. |

Thinking through these categories ensures you're building a complete list, not just focusing on the most obvious names. This broader view is where some of the best strategic insights often come from.

Gathering Meaningful Competitor Intelligence

Alright, you've got your list of competitors. Now the real work begins. It’s time to roll up your sleeves and dig into the data that actually matters—the kind of intelligence that reveals their entire playbook. We're moving beyond a simple list of names and into a full-blown dissection of their marketing, sales, and product strategies.

This isn't just a box-ticking exercise. Getting this right is what separates the winners from the also-rans. It's no surprise the Business Intelligence (BI) market is projected to hit a staggering $78.42 billion by 2032. Companies are pouring money into real-time data collection and BI tools to keep tabs on everything from competitor pricing to new product launches. This is the level of detail we're aiming for.

Analyze Their SEO and Content Strategy

A competitor's SEO and content strategy is basically their public roadmap for attracting customers. By picking it apart, you can see exactly which keywords they’re betting on, what topics their audience craves, and—most importantly—where the gaps are for you to swoop in.

Start with their organic keyword footprint. You need to know which search terms they own, especially the high-intent phrases that lead directly to sales. For a much deeper dive on this, our guide on https://copymasters.co/blog/keyword-research-best-practices is a great starting point.

Here's what I always look for:

- Top-Performing Keywords: Which keywords are sending them the most traffic? Are they informational queries (like "how to do X") or commercial ones ("best software for Y")? This tells you where they're focusing their energy.

- Content Gaps: What relevant keywords are they completely missing? These are your low-hanging fruit. Go create content around these terms and start stealing their traffic.

- Backlink Profile: Who's linking to them and why? Their backlinks point you directly to their most authoritative content and can even uncover potential partners for your own outreach.

Tools like Semrush are perfect for getting a quick, high-level view of a competitor's organic presence.

A dashboard like this gives you an instant snapshot of their authority, traffic volume, and top keywords. It's the perfect baseline to measure your own efforts against.

Dissect Their Product and Pricing

How a competitor prices their product and structures their feature tiers is incredibly revealing. It tells you exactly who they believe their ideal customer is and what they think is most valuable about their offer.

Your goal isn't just to see what they charge, but to understand why they charge it. This insight helps you position your own offerings more effectively, whether that means competing on price, features, or service.

Make sure you get granular here.

- Feature Comparison: I like to create a simple spreadsheet comparing my features against each main competitor. Be honest about where you win, where you're on par, and where you're falling short.

- Pricing Tiers: Do they use a freemium model? Tiered subscriptions? One-time fees? Each model attracts a different kind of buyer and signals a specific go-to-market strategy.

- Unique Selling Proposition (USP): Read their homepage and product pages. What's the one thing they shout about constantly? Is it speed, support, a killer feature? That's what they believe is their core advantage.

Monitor Social Media and Customer Reviews

Want the raw, unfiltered truth about your competitors? Head straight to social media and review sites. This is where you find out what customers really think—the good, the bad, and the ugly.

Forget about vanity metrics like follower counts. What you're looking for is the real story in the comments and replies. Is their support team constantly putting out fires? Or are customers evangelizing the product with user-generated content?

Sites like G2 and Capterra are goldmines for spotting recurring complaints that point to weaknesses in their product or service. If you're up against public companies, learning how to analyze earnings calls can also give you an inside look at their strategic priorities and performance. When you combine this kind of public financial data with direct customer feedback, you get a powerful, 360-degree view of where they truly stand.

Choosing Your Competitor Analysis Toolkit

Let's be honest: trying to manually collect all the data for a proper competitor analysis is a losing battle. It's not just slow; it's a surefire way to miss the crucial details that actually make a difference. The right tools do the heavy lifting for you, saving you days of work and uncovering insights you’d never find on your own.

Building a great toolkit isn't about finding one magical platform that does everything. It’s more like assembling a specialized team. You need a scout for SEO, a listener for social media, and a detective for their advertising. Each tool plays a distinct role in building a complete picture of where your rivals stand.

Essential Tools for SEO and Content Insights

Your competitors' SEO and content strategies are essentially an open book—if you know how to read them. The right tools let you deconstruct how they pull in organic traffic, which topics their audience loves, and where they’re building their authority online.

A solid SEO platform is non-negotiable here. It’s the cornerstone of your digital intelligence.

- All-in-One SEO Platforms (Semrush, Ahrefs): These are the industry heavyweights. They'll show you exactly which keywords your competitors are ranking for, give you solid estimates of their organic traffic, and break down their entire backlink profile. This is the raw data you need for https://copymasters.co/blog/improving-search-engine-rankings and spotting content gaps you can fill.

- Content Exploration Tools (BuzzSumo): Ever wonder what content is actually a hit in your niche? BuzzSumo tells you. It reveals the most shared articles, videos, and posts for any topic or competitor, giving you a direct line into what your shared audience finds engaging.

By using these in tandem, you can pinpoint the exact keywords and topics driving traffic to your competition and start building a strategy to win some of that audience for yourself.

Monitoring Social Media and Brand Sentiment

Social media is the stage where your competitors’ brand personalities shine—and where their customers give brutally honest feedback. Watching this space gives you the qualitative context that numbers alone can't provide. You get a real feel for their tone, customer service, and how people really see them.

As you look for the right tools, check out some of these social media competitor analysis tools to see what fits your workflow and budget. Key features to look for include:

- Sentiment Analysis: Tools like Brandwatch can track competitor mentions and automatically flag whether the chatter is positive, negative, or just neutral.

- Engagement Tracking: Platforms such as Sprout Social let you benchmark your own engagement rates (likes, shares, comments) directly against your competitors across all major social networks.

Don't just track follower counts. A competitor with a smaller but fiercely loyal and engaged audience can be a much bigger threat than one with a huge, silent following. The real story is in the conversations.

The Growing Role of AI in Your Toolkit

Artificial intelligence is quickly becoming a game-changer for competitive intelligence. In fact, by 2025, AI is expected to completely reshape how businesses gather market intelligence.

We're already seeing this happen. Modern tools from Semrush and BuzzSumo now use AI to offer pre-built workflows for tracking competitor pricing and marketing campaigns in near real-time. This means your insights are based on what's happening now, not weeks ago. Multimodal AI is also on the horizon, promising to analyze text, images, and video together for a much richer understanding of a competitor's strategy.

This shift means it’s time to start integrating platforms with AI-driven features into your toolkit. These systems can spot patterns and predict competitor moves with a speed and accuracy that manual analysis just can’t touch. Assembling an affordable, powerful toolkit is what turns data collection from a chore into a real strategic advantage.

Using Frameworks to Uncover Hidden Insights

Raw data is just noise. A giant spreadsheet filled with your competitor’s keywords, ad spend, and social media posts won’t tell you what to do next. To turn all that information into a real strategic advantage, you need a framework—a model to help you organize the chaos and start connecting the dots.

Think of a framework as a blueprint for your analysis. It gives your research structure, ensuring you don’t just get lost in isolated data points. This is how you go from knowing what your competitor is doing to understanding why it works (or doesn't) and what it all means for your business.

Modernizing the SWOT Analysis for Digital Competitors

One of the most reliable frameworks out there is the classic SWOT analysis. But for our purposes, we need to adapt it for the digital age. Instead of thinking about broad business strengths, we're going to apply it directly to a competitor's online presence. This focused approach yields incredibly specific and actionable insights.

A digital SWOT helps you map out a competitor's entire online ecosystem.

- Strengths: What are they genuinely great at online? Maybe they have a massive, engaged email list or rank #1 for a whole cluster of high-intent keywords. It could be their lightning-fast website or their talent for creating viral video content that everyone shares.

- Weaknesses: Where are their digital blind spots? Perhaps their website is a nightmare to use on mobile, or their social media engagement is embarrassingly low despite having thousands of followers. You might also find their customer reviews are littered with complaints about slow support.

- Opportunities: What market needs are they completely failing to meet? This could be an underserved audience they’re ignoring or a content format, like a podcast, they haven't even tried. An opportunity could be as simple as a new social platform where they have zero presence.

- Threats: What external factors could seriously damage their online performance? This might be a new, disruptive competitor gaining market share with a more innovative product. It could also be an upcoming Google algorithm update that seems aimed directly at the kind of SEO tactics they rely on.

Looking at a competitor through this digital SWOT lens forces you to see beyond surface-level metrics. It’s how you uncover the strategic patterns that are really driving their success or failure online.

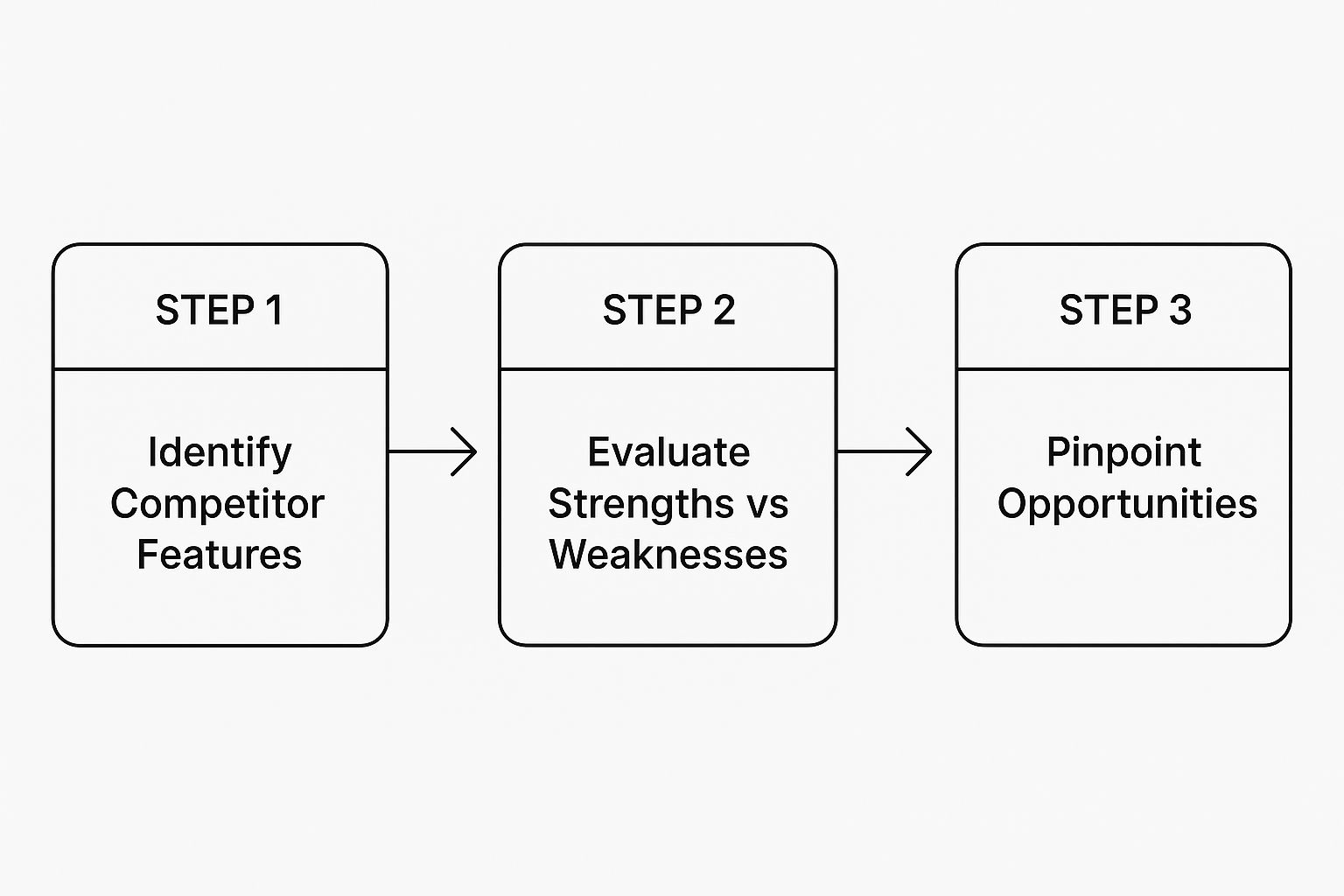

This process gives you a systematic way to break down what your competitors are offering so you can spot where you can win.

By moving from simply identifying competitors to truly evaluating them, you start to see exactly where your product or service has the edge.

I've put together a table that shows how this looks in practice when you're analyzing a competitor's digital marketing efforts.

SWOT Analysis Framework for a Digital Competitor

| Category | Guiding Questions | Example Finding |

|---|---|---|

| Strengths | Where do they excel online? What assets give them an edge? | They have a +500k subscriber email list with an exceptionally high open rate, giving them a direct and powerful communication channel. |

| Weaknesses | What are their digital shortcomings? Where are they vulnerable? | Their mobile website has a poor user experience, with slow load times and a clunky checkout process that likely hurts conversions. |

| Opportunities | Which channels or audiences are they ignoring? What unmet needs can we fill? | They have no presence on TikTok, despite a growing segment of our shared target audience actively using the platform for product discovery. |

| Threats | What external factors could harm their online strategy? | A major search engine algorithm update targeting thin content could devalue a large portion of their blog, which is their primary source of organic traffic. |

Using this kind of structured approach makes it easy to pull out the most important takeaways from your research and turn them into a plan.

Deconstructing Your Competitor's Value Proposition

Beyond a high-level SWOT, you need to dig into the nitty-gritty of their product and messaging. This is where you get into the details that directly influence whether a customer chooses them over you.

Start by looking at how they position themselves. How a competitor talks about their product is often just as important as the product itself. Their messaging is the foundation of their entire marketing strategy, and you need to decode it.

I find a simple table is the best way to track this. As you analyze their website, ads, and social media, fill in the blanks.

| Competitor | Unique Selling Proposition (USP) | Target Audience (Implied) | Primary Benefit Highlighted |

|---|---|---|---|

| Competitor A | "The fastest way to manage projects" | Busy teams in fast-paced industries | Speed and efficiency |

| Competitor B | "The simplest tool for freelancers" | Solopreneurs and small agencies | Ease of use and simplicity |

| Competitor C | "All-in-one platform for enterprises" | Large organizations | Integration and scalability |

Mapping this out quickly reveals where the market is crowded and where you might find an opening. For instance, if everyone is shouting about features, maybe you can win by focusing on exceptional customer support or by positioning your product for a niche audience they're all ignoring.

These frameworks are what transform scattered data points into a clear strategic roadmap, shining a light on the exact gaps in the market where your business can thrive.

Turning Your Analysis Into a Winning Strategy

This is the moment where all your hard work pays off. An analysis packed with data is interesting, but it's completely useless if it doesn't inspire action. This is where you translate your meticulous research into a clear, decisive plan that gives your business a real competitive edge.

The goal isn't just to list findings; it's to build a compelling story that points directly to your next moves. Without this crucial step, even the most thorough competitor analysis ends up as a document that collects dust.

Synthesize Your Findings into a Clear Narrative

Before you can build a plan, you need to simplify the complexity. You've likely gathered hundreds of data points, from keyword rankings to customer complaints. Now, it's time to distill all that noise into two critical takeaways: your single biggest opportunity and your most urgent threat.

This isn't about everything you found, but about the one thing that could propel you forward and the one thing that could hold you back.

Your Biggest Opportunity: Look for the clear, uncontested gap in the market. Maybe it's a customer segment your rivals are ignoring, a content pillar they haven't touched, or a product feature everyone is complaining about. For example, if all your competitors focus on enterprise clients, your big chance might be creating a streamlined, affordable solution for freelancers.

Your Most Urgent Threat: What's the competitor action or market shift that poses the most immediate danger? It could be a new disruptor rapidly gaining market share with a lower price point, or maybe a legacy brand is launching a product that directly competes with your core offering.

Identifying these two points gives your team a powerful sense of focus. It transforms a scattered list of observations into a clear call to action.

Prioritize Actions with an Impact vs. Effort Matrix

Okay, so you’ve pinpointed your primary opportunity and threat. Now you probably have a list of potential actions to take, but the challenge is figuring out where to start. A simple but incredibly effective way to do this is with an Impact vs. Effort Matrix.

This framework is fantastic for avoiding low-value tasks and instead focusing your resources where they’ll make the biggest difference.

By plotting potential actions on a simple four-quadrant grid, you can instantly visualize which initiatives offer the best return on your team's time and energy, separating the game-changers from the time-wasters.

Just draw a simple chart with "Impact" on the vertical axis and "Effort" on the horizontal axis. Then, place your ideas into one of the four quadrants:

- High Impact, Low Effort (Quick Wins): These are your top priorities. A great example might be optimizing your top five landing pages based on weaknesses you found in competitor messaging.

- High Impact, High Effort (Major Projects): Think of these as long-term strategic initiatives, like developing a new product feature to fill that major market gap you identified. Plan these carefully.

- Low Impact, Low Effort (Fill-ins): These are tasks to tackle when you have spare capacity, like updating old blog posts with new internal links.

- Low Impact, High Effort (Time Sinks): Avoid these at all costs. This could be something like trying to compete on a highly saturated social media channel where your competitors are already dominating.

This exercise provides immediate clarity and helps you build a much more realistic roadmap.

Build Your Action Plan with Measurable Goals

The final step is to formalize your priorities into a concrete action plan. Every single initiative should be defined with clear, measurable goals. This is how you ensure your research leads to tangible business results.

For each key action, your plan should detail:

- Specific Goal: What exactly will you achieve? (e.g., "Rank in the top 5 for the keyword 'X'").

- Owner: Who is responsible for getting this done?

- Timeline: When will this be completed?

- Key Metrics: How will you measure success? (e.g., organic traffic, conversion rate, SERP position).

For instance, if your analysis revealed a content gap, a measurable goal would be to publish three blog posts on that topic cluster within the next month. Success isn't just hitting "publish"—it's tracking the results. To learn more, check out our guide on how to measure content performance and tie your efforts back to real business outcomes.

This structured approach is what makes competitor analysis a continuous growth engine. It transforms insights from a one-off report into a repeatable process for outmaneuvering the competition.

Common Competitor Analysis Questions

When you start digging into competitive intelligence, you’ll find a few questions always seem to surface. How often should I be doing this? How do I figure out what my competitor charges when they don't list prices? It's these practical details that can make or break your analysis.

Let's walk through some of the most common questions I hear and get you some straight answers.

How Often Should I Conduct Competitor Analysis?

There’s no magic number here. The right cadence for your analysis really depends on how fast your industry moves. If you're in a dynamic space like e-commerce or SaaS, you might need to run a full analysis every 3-4 months. For more traditional, slower-moving industries, a deep dive every 6-12 months might be plenty.

The biggest mistake I see is people treating this as a one-and-done task. You check the box and forget about it for a year. That’s a recipe for getting blindsided.

Think of it this way: you have your big, deep-dive analysis, and then you have your ongoing monitoring. The deep dive happens quarterly or semi-annually. But the monitoring? That’s constant. Set up alerts. Use your tools. Keep a casual eye on your top 3-5 rivals so you know the second they launch a major campaign or product. This way, you're never caught completely off guard.

My rule of thumb: Always schedule a fresh, full analysis before any major strategic decision. Planning a product launch? A pricing overhaul? A big marketing push? You need the latest intel to make sure you're not flying blind.

How to Analyze Competitor Pricing Without Direct Data

This is a classic problem, especially for B2B or service businesses where pricing is hidden behind a "Request a Quote" button. It's rare for a competitor to just hand over their price list. But that doesn’t mean you’re out of options. You just have to put on your detective hat.

You can piece together a pretty clear picture by looking for the clues they leave behind.

Reading Between the Lines

- Listen to their language. Are they using words like "affordable," "flexible," or "value-packed"? Or is it all "premium," "enterprise-grade," and "robust"? Their word choice is a massive signal about who they’re targeting and how they position their price point.

- Dig through customer reviews. Check sites like G2 or Capterra. You'll often find gold nuggets in the comments, like, "It's a bit pricey, but the support is worth every penny," or "A much more affordable option than Competitor X."

- Examine their case studies. Who are their star customers? A case study featuring a Fortune 500 giant tells a very different pricing story than one focused on a local mom-and-pop shop. The scale of their clients gives you an indirect clue about the scale of their prices.

- Become the prospect. When it feels appropriate and doesn't cross any ethical lines, go through their sales funnel. Request a demo. Talk to a sales rep. This gives you firsthand insight into not just their pricing structure, but how they justify it and frame their value.

By pulling these threads together, you can build a very solid hypothesis about their pricing model without ever seeing a public price tag.

Keeping Your Competitor Research Ethical

Let’s be crystal clear: there's a huge difference between competitive intelligence and corporate espionage. Our goal is to gather publicly available information to make smarter business decisions. It’s not about being sneaky or doing anything illegal. Keeping your research clean is non-negotiable.

Here are a few simple ground rules to live by:

- Public Info Only: Stick to information that anyone can find. This means their website, social media, press releases, blog posts, public financial filings—it's all fair game.

- Don't Misrepresent Yourself: Never, ever lie about who you are to get information. Posing as a customer under false pretenses or creating fake profiles to get access is a serious ethical breach.

- Respect the Rules of the Road: Pay attention to a website's Terms of Service and

robots.txtfile. If they ask crawlers not to scrape a certain part of their site, respect that. - Never Touch Stolen Data: This should be obvious, but I'll say it anyway. If information was obtained through hacking, theft, or any other illegal means, it has no place in your analysis. Period.

Ethical intelligence is about being a great observer and analyst, not a spy. There's more than enough public data out there to build a winning strategy without ever stepping into a gray area.

Ready to turn your competitor analysis into a content strategy that actually dominates the search results? At Copy Masters, we specialize in creating search-optimized articles that help you outrank your rivals and drive consistent traffic.

Discover how our SEO Content System can become your secret weapon.

- SaaS SEO Consulting for Predictable Growth - October 20, 2025

- What Is SEO Management Your Guide to Real Results - October 19, 2025

- A Guide to Quality Content for SEO That Ranks - October 18, 2025